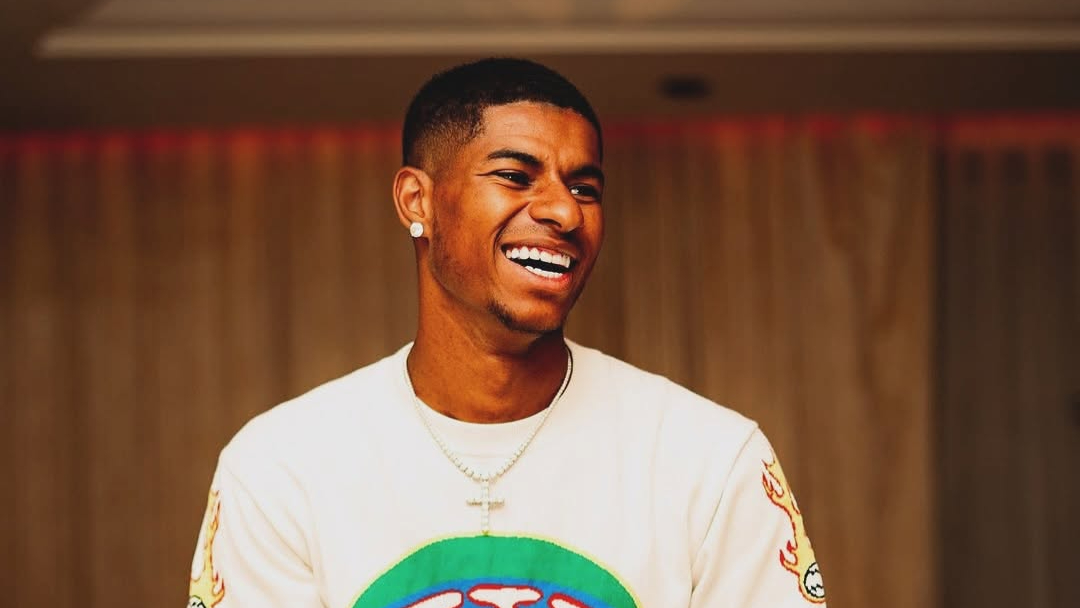

Marcus Rashford’s Investment Firm Faces Legal Trouble: What’s Next?

Marcus Rashford, the Manchester United football star, has recently found himself facing legal trouble with his investment firm, MUCS Investments Limited. The company, founded in January 2021, has been issued a compulsory strike-off notice from Companies House due to its failure to submit its financial accounts for the year ending 30 January 2024. The company’s inability to meet the 30 October 2024 deadline for filing its accounts has put the firm in a precarious situation.

This move by Companies House is not only a legal formality but could have serious repercussions for the company and Rashford himself. If the strike-off process goes ahead, the company’s assets will revert to the Crown, effectively dissolving the firm. Moreover, Rashford, who is the sole director of MUCS Investments, could face disqualification from serving as a director for up to 15 years. Furthermore, the company would lose access to its banking facilities, which would severely hamper its ability to manage any investments or financial transactions.

The news surrounding the strike-off notice is particularly concerning given the firm’s purpose and Rashford’s position in the public eye. MUCS Investments was established as a means for Rashford to manage his personal investments and diversify his wealth outside of football. For someone with a high-profile career like Rashford, managing investments with transparency and accountability is crucial, both for personal financial success and for maintaining a positive public image.

A Closer Look at MUCS Investments Limited

MUCS Investments Limited was founded with the aim of managing the various business ventures and investments that Marcus Rashford has embarked upon since his rise to prominence. Rashford, who is not only known for his football career but also for his philanthropic work, particularly in the area of child food poverty and education, has consistently been looking for ways to secure his financial future. As a high-earning athlete, diversifying his financial portfolio beyond football is both a smart and necessary move.

However, the failure to comply with basic legal requirements such as submitting annual financial accounts has brought his investment firm into the spotlight for all the wrong reasons. While the company’s purpose might have been noble and well-intentioned, its inability to meet these obligations raises serious questions about the management of Rashford’s financial affairs. In addition to the legal implications, this situation also damages the reputation of the firm and its ability to attract future investors or business partners.

The strike-off notice from Companies House is a stark reminder of the importance of adhering to regulatory requirements in the business world. Even well-established, high-profile figures like Marcus Rashford are not immune to the consequences of non-compliance. Companies are legally obligated to file financial accounts annually, and failing to do so can result in dissolution, disqualification from directorship, and the loss of vital banking facilities. For Rashford, this is a significant business setback, as MUCS Investments was meant to serve as a long-term vehicle for wealth growth and diversification.

What Could Happen Next for Rashford and MUCS Investments?

While the strike-off process has been initiated, Marcus Rashford and his team still have an opportunity to rectify the situation before the company is officially dissolved. There is a period during which the company can appeal or submit the missing financial accounts. If Rashford and his team act swiftly, they can prevent the company from being struck off the register. However, if they fail to do so, the consequences could be severe.

The assets of MUCS Investments Limited would be transferred to the Crown, which means Rashford would lose control over any investments or assets managed by the firm. This would be a significant financial blow to Rashford, as it could mean the loss of business ventures that were supposed to grow his wealth outside of football.

Additionally, Marcus Rashford could face legal consequences in the form of a director disqualification. Under UK company law, directors who fail to comply with their legal duties can be banned from serving as a director for up to 15 years. This would have long-term implications for Rashford’s ability to pursue any future entrepreneurial ventures, potentially affecting his reputation as a businessman. Given Rashford's current status as a public figure and his philanthropic efforts, a director disqualification could harm his image and affect his credibility in the business world.

The Broader Picture: Implications for High-Profile Entrepreneurs

Rashford’s predicament serves as an important lesson for high-profile individuals who decide to establish business ventures outside of their primary careers. The reality of managing a business is far more complex than simply making investments and generating returns. It also involves adhering to legal regulations, ensuring transparency, and maintaining proper financial oversight. Rashford’s situation is a reminder that the world of business, while lucrative, is fraught with legal requirements that must be taken seriously.

In the case of Rashford, his business dealings are closely linked to his public persona, and any misstep could have repercussions beyond just financial losses. His fans and the public closely follow his philanthropic and business ventures, which means his actions in the business world are scrutinized more than most entrepreneurs. The same scrutiny applies to other high-profile figures, such as athletes, entertainers, and celebrities, who often set up investment firms to manage their wealth outside of their primary careers. If they fail to manage their businesses properly, it can lead to damage to their personal reputation and public image.

Related: Bernie Madoff Victims Recover 94% of Their Losses: A Decade of Restitution Concludes

Lessons for Future Entrepreneurs

Rashford’s situation underscores the need for all entrepreneurs—especially those in the public eye—to ensure that their businesses operate in compliance with legal requirements. While starting and running a business can be exciting and rewarding, it also requires attention to detail and a commitment to following the rules. For anyone looking to follow in Rashford’s footsteps, either in sports or another field, it’s important to have the right support system in place. This includes hiring professional accountants, legal advisors, and financial experts to ensure compliance and maintain proper business operations.

In Rashford’s case, it’s likely that this strike-off notice is just a temporary setback. However, it’s an important reminder for him and other entrepreneurs about the significance of regulatory compliance and the potential risks of neglecting essential business obligations.

Rashford’s Business Setback and the Path Forward

Marcus Rashford’s investment firm, MUCS Investments, faces a challenging future due to its failure to submit financial accounts on time. However, the situation is not beyond repair, and Rashford still has the opportunity to address the issue before the company is dissolved. The incident serves as a cautionary tale for entrepreneurs, particularly high-profile individuals, about the importance of adhering to legal requirements and maintaining proper oversight of their businesses.

As Rashford moves forward, it is essential for him and other public figures to understand the complexities of managing a business and the potential consequences of non-compliance. The key takeaway for any entrepreneur is that business success relies not only on strategy and investments but also on meeting regulatory obligations and maintaining transparent and accountable operations.