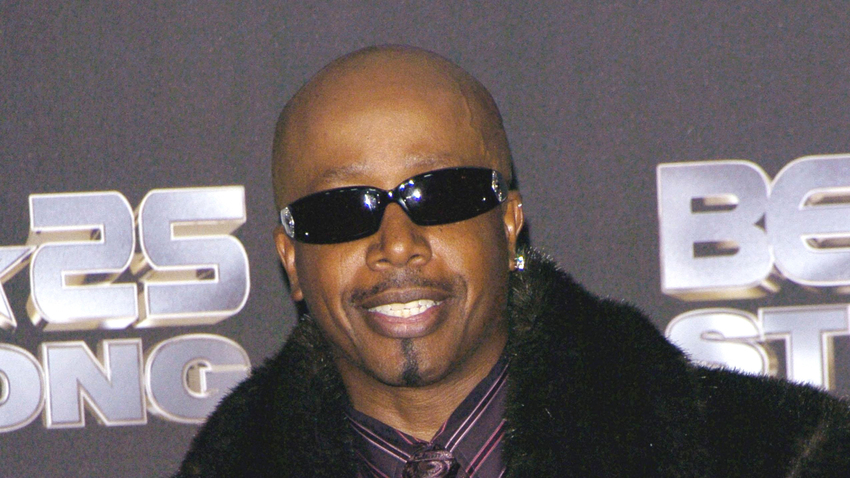

MC Hammer’s Rise and Fall: From $70 Million to Bankruptcy

In the early 90s, MC Hammer was on top of the world. With chart-topping hits like “U Can’t Touch This” and “2 Legit 2 Quit”, Hammer amassed an estimated $70 million fortune at the height of his fame. But as quickly as the money poured in, it vanished. By 1996, the rapper, whose real name is Stanley Kirk Burrell, was forced to file for bankruptcy after racking up $13 million in debt.

So how did MC Hammer go from millionaire status to losing everything? The answer lies in a dangerous mix of extravagant spending, bad financial decisions, and mismanagement of his empire.

MC Hammer’s Meteoric Rise to Fame

MC Hammer burst onto the music scene in the late 80s and early 90s with his high-energy beats, flashy dance moves, and signature parachute pants. His 1990 album “Please Hammer, Don’t Hurt ‘Em” sold over 10 million copies and made him the first hip-hop artist to achieve diamond certification.

At his peak, Hammer was raking in $30 million a year. Between endorsements, merchandise, and sold-out tours, he was living the dream—and spending like a king.

Related: 13 Celebrities Who Lost Their Fortunes

The Lavish Lifestyle That Drained His Fortune

MC Hammer’s success led to a lavish lifestyle that was difficult to sustain. His spending habits included:

A $12 Million Mansion: Hammer bought a sprawling 40,000-square-foot mansion in Fremont, California, which he customized to his taste—adding gold-plated gates, a recording studio, and a luxurious pool. But the home’s maintenance alone cost $500,000 annually.

A 200-Person Entourage: Hammer employed over 200 friends and family members, paying them extravagant salaries. While some were bodyguards, dancers, and assistants, many had vague roles that were never clearly defined.

Expensive Shopping Sprees: Hammer’s wardrobe, jewelry, and custom designer outfits were legendary. He often splurged on luxury cars, private jets, and extravagant gifts for friends and family.

Costly Stage Productions: Hammer’s concerts were famous for their high-energy choreography and flashy productions, which included dozens of dancers and elaborate sets—costing millions to produce.

When the Music Stopped: Hammer’s Fall from Grace

As music trends shifted from upbeat hip-hop to the grittier sounds of gangster rap in the mid-90s, MC Hammer’s popularity began to wane. Album sales plummeted, and his income dried up—but his spending didn’t slow down.

Hammer’s entourage remained on the payroll, his mansion needed constant maintenance, and his over-the-top lifestyle continued even as his earnings dwindled.

With more money going out than coming in, Hammer was soon drowning in debt.

Related: How Burt Reynolds Lost His Fortune

Related: Johnny Depp’s $650 Million Nightmare: How He Lost It All and Is Fighting Back

Bankruptcy: The $13 Million Debt Spiral

By 1996, MC Hammer found himself in a financial disaster. Unable to keep up with his extravagant spending, he filed for Chapter 11 bankruptcy, revealing a staggering $13 million in debt.

The bankruptcy process forced Hammer to sell off his prized possessions, including his beloved mansion and luxury cars. Despite the humiliation and public scrutiny, Hammer admitted he had no choice.

The IRS Comes Knocking: $800,000 Tax Bill

Even after filing for bankruptcy, Hammer’s financial troubles were far from over. In 2013, the IRS hit Hammer with an $800,000 tax bill for unpaid taxes dating back to 1996. Despite being long past his prime earning years, Hammer found himself struggling to repay his debts.

Related: Pamela Anderson’s $70 Million Fall: How She Lost It All and Rebuilt Her Life

The Road to Redemption: Hammer’s Comeback

After hitting rock bottom, MC Hammer slowly rebuilt his life. He turned to ministry and technology ventures to regain his financial footing.

🔹 Tech Investments: Hammer invested in several Silicon Valley tech companies, including Twitter and Square, which helped him regain some of his lost wealth.

🔹 Preaching and Philanthropy: He became a minister and motivational speaker, using his experiences to educate others on financial literacy and the dangers of overspending.

Lessons from Hammer’s Financial Collapse

MC Hammer’s story serves as a cautionary tale for anyone who experiences sudden wealth. His fall from grace highlights the importance of living below your means, managing financial obligations, and seeking professional guidance when dealing with large sums of money.

Key Takeaways:

Don’t Overspend: No amount of money can withstand continuous reckless spending.

Invest Wisely: Building multiple streams of income can protect against financial instability.

Prepare for the Future: Popularity and success can be fleeting, so long-term planning is essential.

A Hard Lesson in Money Management

MC Hammer’s rise, fall, and slow return to stability is a lesson in financial responsibility. His $70 million fortune disappeared almost as quickly as it was amassed, but his story offers a roadmap for avoiding similar mistakes.

As Hammer himself once said, “I had too much money and not enough sense.” And that’s a lesson no one wants to learn the hard way.