The Power of CEO Popularity: How Reputation Drives Business Success

A CEO is more than just a company leader—they are the face of the brand, the voice of innovation, and a key driver of investor confidence. A strong CEO reputation can elevate a company’s value, while public disapproval can cause stock prices to plummet.

Recent trends show that investors, customers, and employees are increasingly influenced by CEO popularity, making corporate leadership as much about branding as business strategy. Let’s explore how CEO perception impacts business performance, with real-world examples like Elon Musk and Tesla’s stock struggles.

How CEO Reputation Affects a Company’s Success

A CEO’s public persona, leadership style, and social influence have a direct impact on financial performance. According to research, 77% of adults say a CEO’s reputation affects their willingness to invest, with millennials being the most influenced at 84%.

This connection is evident in two key areas:

- Stock Market Reactions: Investors respond to CEO actions, statements, and scandals—often in real time.

- Brand Trust & Consumer Loyalty: Consumers associate CEOs with their company’s values, affecting purchasing decisions.

Case Study #1: Elon Musk & Tesla’s Stock Decline (2025)

Elon Musk is a textbook example of how CEO reputation can impact business performance—both positively and negatively.

2021–2023: Musk’s cult-like following boosted Tesla’s stock to record highs. His bold moves, from accepting Bitcoin payments to expanding self-driving tech, created immense investor excitement.

2024–2025: However, public perception shifted. Musk’s controversial social media posts, erratic leadership style, and divisive political views alienated consumers and investors.

The result? Tesla’s stock plunged in early 2025, losing billions in market value as investors lost confidence in Musk’s leadership.

Key Takeaway: When a CEO’s brand becomes a liability, their company suffers financially.

Related: Elon Musk’s First Month in Politics and Its Impact on Tesla

Related: Tesla Faces Sales Challenges Amid Elon Musk’s Controversial Public Image

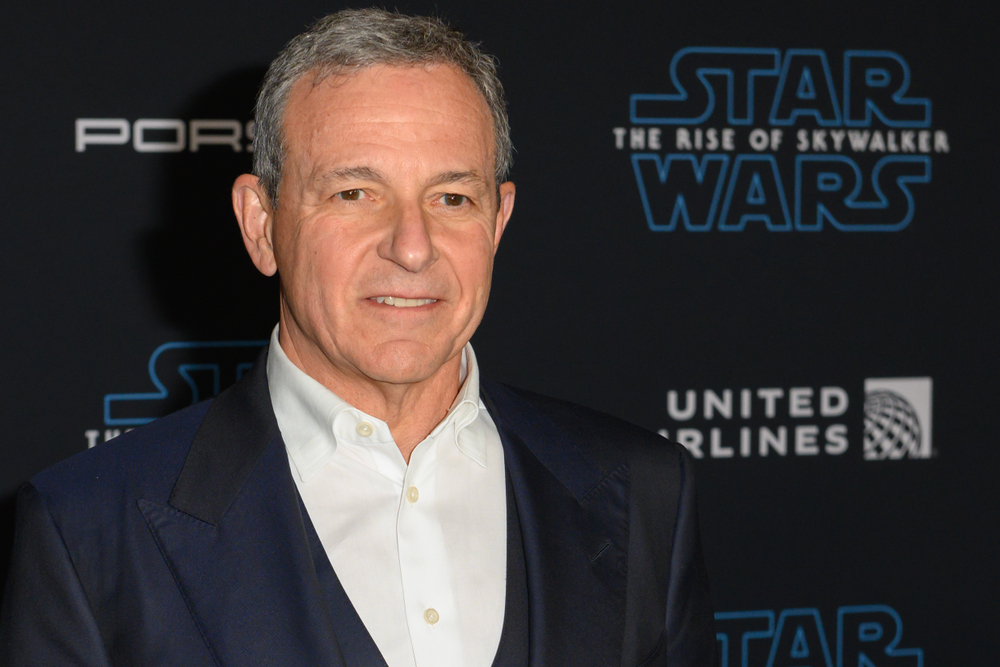

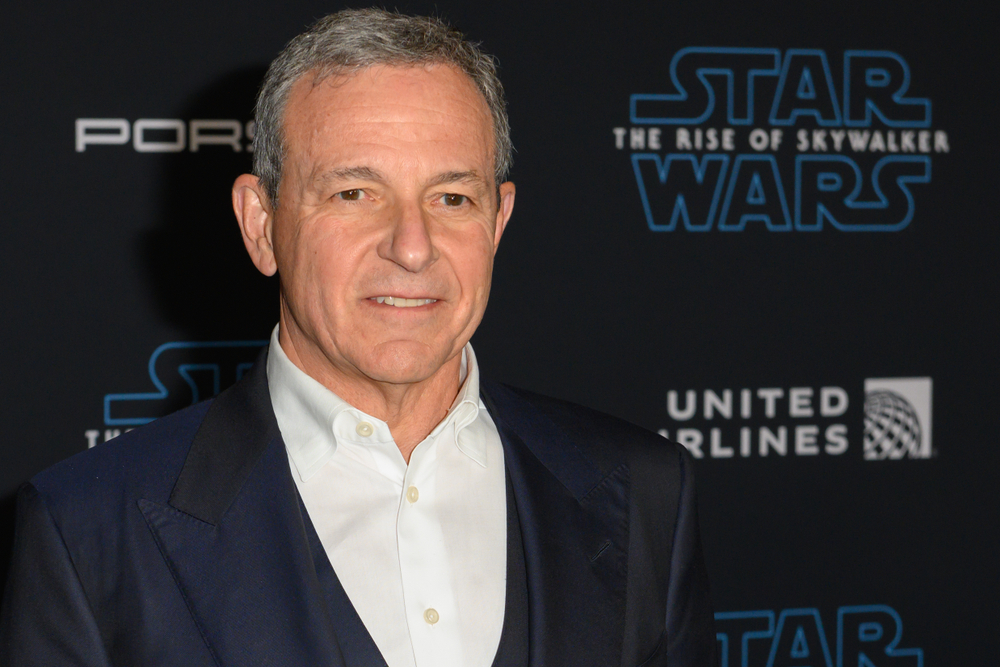

Case Study #2: Bob Iger & Disney’s Rebound

On the flip side, a strong, respected CEO can rescue a struggling company.

2020–2022: Disney faced financial turmoil, declining streaming revenue, and backlash over political controversies. Former CEO Bob Chapek struggled to navigate the brand’s public perception.

2023: Bob Iger returned as CEO, immediately boosting investor confidence. His leadership style, reputation for innovation, and ability to rebuild Disney’s brand image led to stock recovery and increased revenue.

Related: Bob Iger’s Biggest Wins & Worst Blunders: The Disney CEO’s Rollercoaster Reign

Key Takeaway: A trusted, strategic CEO can turn a struggling company into a success story.

The Future of CEO Thought Leadership

As social media and corporate transparency continue to shape consumer and investor decisions, CEO reputation will become even more critical.

Companies must carefully manage their CEO’s public persona, ensuring it aligns with brand values.

Investors will prioritize companies with respected, visionary leaders who inspire confidence in long-term growth.

Consumers will increasingly expect CEOs to be accountable, ethical, and aligned with social responsibility.

Why CEO Popularity Matters

A CEO is no longer just a business executive—they are a brand, an influencer, and a key factor in financial performance. From Elon Musk’s Tesla turbulence to Bob Iger’s Disney revival, the evidence is clear:

A great CEO can skyrocket a company’s value.

A controversial CEO can destroy investor trust.

As the business world evolves, CEO reputation will be a powerful determinant of success or failure.