Kenneth Lay: The Fall of Enron’s Charismatic Founder

A Powerful Rise in Corporate America

Kenneth Lay, born in 1942 in Missouri, rose from humble beginnings to become one of the most powerful executives in American business. With a PhD in economics, Lay worked in both government and private industry before founding Enron in 1985 through a merger of Houston Natural Gas and InterNorth.

As Enron’s chairman and CEO, Lay was a respected figure on Wall Street. He was known for his political connections, polished image, and visionary talk of deregulating the energy industry. Under his leadership, Enron transformed from a regional pipeline company into an ambitious energy trading powerhouse.

What Exactly Did Ken Lay Do?

While Ken Lay wasn’t involved in the day-to-day financial engineering that led to Enron’s collapse, he played a key role in enabling the culture that allowed fraud to flourish. Lay championed aggressive deregulation and publicly promoted Enron as a model of innovation and financial success even as its internal finances crumbled.

Lay was well aware of the company’s growing instability but continued to reassure investors and employees that everything was fine. He sold millions in stock while encouraging staff to keep buying, ultimately shielding himself while others lost their savings and pensions.

When Did Ken Lay Step Down from Enron?

Ken Lay stepped down as CEO in February 2001, appointing Jeff Skilling as his successor. When Skilling abruptly resigned in August 2001, Lay returned to the CEO role, attempting to stabilize the company. However, the damage was already done. Enron filed for bankruptcy in December 2001, erasing $74 billion in shareholder value and marking one of the most catastrophic corporate collapses in history.

What Happened to Ken Lay and Jeff Skilling?

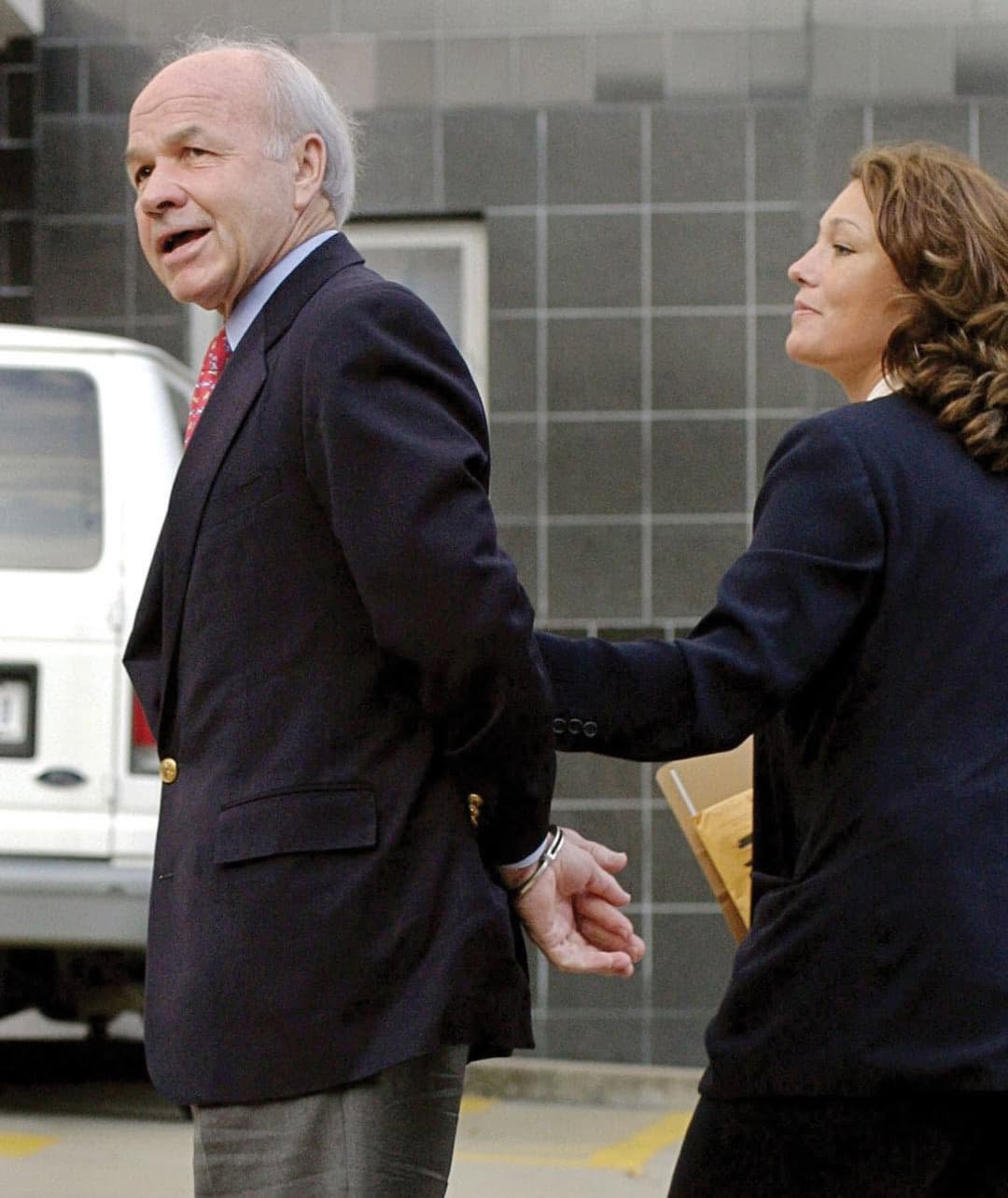

Both Lay and Skilling were tried in 2006 for their roles in Enron’s fraudulent practices. Lay was found guilty on 10 counts, including conspiracy and securities fraud. However, before he could be sentenced, Lay died of a heart attack on July 5, 2006, while vacationing in Colorado. His death occurred just six weeks after the guilty verdict.

Because he died before sentencing, his convictions were vacated under a legal doctrine that erases criminal responsibility if a defendant dies before exhausting the appeals process.

Skilling, on the other hand, was sentenced to 24 years in prison (later reduced), serving more than a decade before being released in 2019.

Conclusion

Kenneth Lay was the face of Enron’s rise and its ultimate fall. While he did not mastermind the fraudulent accounting practices, his leadership created the environment where they could thrive. His charisma, political influence, and public persona shielded a company that was hollow at its core.

Lay’s story is a lesson in accountability. It reveals how CEOs must not only drive profits, but also set a moral compass for their organizations. His fall from grace remains a symbol of how unchecked ambition and complacency at the top can devastate thousands of lives—and shatter public trust in corporate leadership.