The $50 Billion Gamble: How Masayoshi Son Revolutionized Tech Investment

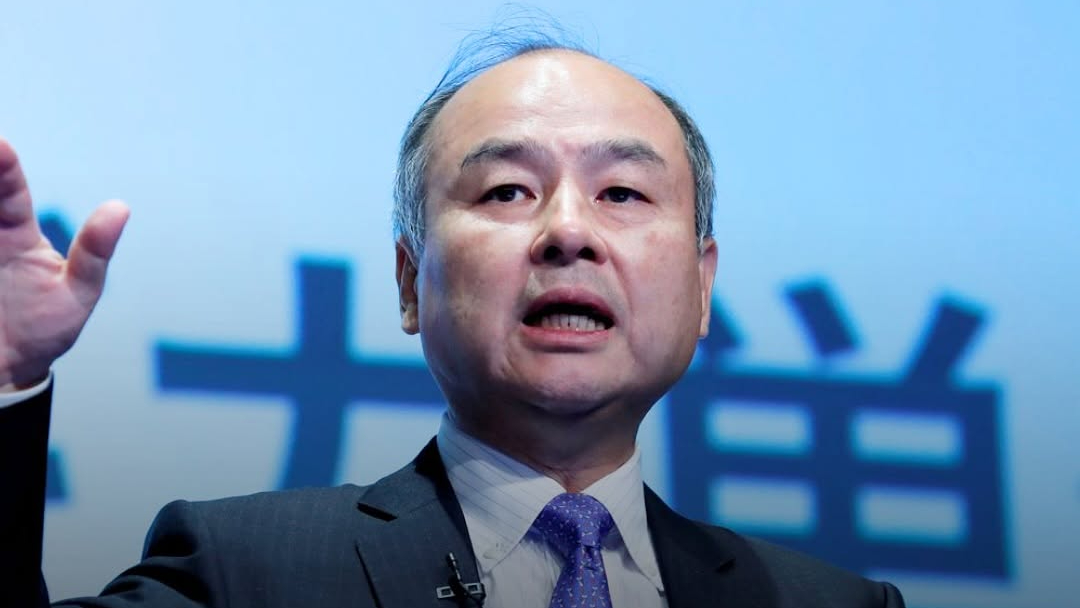

The Visionary Behind Japan's Investment Powerhouse

In the high-stakes world of global technology investment, few figures command attention like Masayoshi Son. Often compared to legendary investor Warren Buffett, Son has forged a dramatically different path—one built not on cautious value investing, but on audacious, future-focused bets that have transformed entire industries.

As the architect behind SoftBank Group, Son has repeatedly demonstrated a remarkable ability to identify transformative technologies before they reach mainstream recognition. His meteoric rise from software distributor to global technology kingmaker provides invaluable lessons for today's business leaders navigating digital transformation.

From Humble Origins to Tech Titan

Born to Korean immigrants in Japan in 1957, Son's journey embodies the entrepreneurial spirit. Brilliant and restless from an early age, he found his way to the University of California, Berkeley, where he studied economics while simultaneously nurturing his passion for technology innovation.

What began as a modest software distribution company in 1981 has evolved into a global investment juggernaut worth over $100 billion. This extraordinary transformation reflects Son's uncanny ability to anticipate technological shifts and position his enterprise at the forefront of digital revolution.

The Five-Minute Decision That Generated $50 Billion

Perhaps no investment better exemplifies Son's extraordinary instinct than his legendary 2000 meeting with Jack Ma, the founder of then-obscure Chinese e-commerce platform Alibaba. While conventional investors hesitated, Son made a decision that would enter the annals of business history.

"I invested based on my sense of his eyes," Son later revealed, describing how he committed $20 million for a 34% stake in Ma's struggling startup after just five minutes of conversation. This instinctive judgment—seemingly reckless by traditional investment standards—transformed into one of the most profitable technology investments ever recorded, eventually worth over $50 billion.

Related: Inside Japan's Billionaire Club: The Top 5 Richest Tycoons of 2025

Building a Global Technology Empire

Son's approach to wealth creation defies conventional investment wisdom. Rather than diversifying broadly or seeking immediate returns, he has consistently placed concentrated bets on transformative technologies and visionary founders. SoftBank's evolution traces a remarkable journey:

- 1981-1990s: Established software distribution foundations before pivoting toward digital media and telecommunications

- 2000-2010: Cemented reputation through strategic investments in Asian tech companies, most notably Alibaba

- 2010-2020: Orchestrated major acquisitions including Vodafone Japan (rebranded as SoftBank Mobile), ARM Holdings, and Sprint

- 2017-Present: Launched the Vision Fund, fundamentally changing the scale and pace of global venture capital

The $100 Billion Vision Fund: Reinventing Venture Capital

In 2017, Son unveiled what many considered impossible: a $100 billion investment vehicle dedicated to funding the technologies that would shape humanity's future. The Vision Fund represented a quantum leap in venture capital scale, deploying unprecedented capital into artificial intelligence, robotics, transportation, healthcare, and financial technology.

This massive funding mechanism has backed industry leaders including:

- Uber

- DoorDash

- ByteDance

- Coupang

- WeWork

While the Vision Fund has faced criticism for its aggressive valuations and spectacular failures—most notably WeWork's collapsed IPO—its sheer magnitude has permanently altered the startup funding landscape.

Related: How Tadashi Yanai Built Uniqlo Into a $30 Billion Global Empire

The Philosophy of Calculated Audacity

What drives Masayoshi Son to make investments that others consider reckless? His approach combines technological foresight with philosophical conviction about humanity's future.

"Information revolution—that's my life's passion," Son has stated repeatedly. He envisions a world transformed by artificial intelligence, where connected devices outnumber humans by thousands to one, and where traditional business models face radical disruption.

This philosophical framework explains Son's willingness to weather significant losses without abandoning his core convictions. After losing nearly $70 billion in the dot-com crash, he famously remarked, "I may seem crazy, but I believe I'm a smart crazy."

Strategic Insights for Tomorrow's Business Leaders

Son's extraordinary journey offers valuable lessons for executives navigating today's accelerating technological landscape:

- Conviction over consensus: Son repeatedly demonstrates that transformative opportunities often appear irrational by conventional metrics

- Technological inflection points create unprecedented wealth: Identifying and heavily investing in fundamental shifts yields outsized returns

- Think in decades, not quarters: Truly revolutionary businesses require patient capital and long-term vision

- Setbacks are inevitable: Even the most successful investors experience spectacular failures alongside their triumphs

The Billionaire Who Funds the Future

Masayoshi Son stands apart from his ultra-wealthy peers not merely for his net worth, but for his unwavering commitment to funding humanity's technological frontier. Where others see risk, he sees transformation. Where conventional wisdom counsels caution, he embraces bold action.

As artificial intelligence, quantum computing, and biotechnology reshape our world, Son's investment philosophy takes on renewed relevance. In a business environment increasingly defined by technological disruption, his approach offers both inspiration and warning: fortune favors the bold, but vision without discipline can lead to spectacular failures.

For today's business leaders, perhaps Son's greatest legacy is his demonstration that in times of profound technological change, the greatest risk may be taking no risk at all.