What Meta’s Trial Means for Investors and the Tech Sector

When a tech titan like Meta (formerly Facebook) ends up in the courtroom, the ripple effects are felt far beyond the legal community. Investors, analysts, and rival companies are watching with sharp interest as Meta faces mounting legal challenges particularly related to antitrust, privacy concerns, and the company’s increasingly dominant position in the digital advertising and social networking ecosystems.

This trial is more than just a legal skirmish — it could be a litmus test for how aggressively regulators intend to pursue Big Tech in the coming years. And for investors, that uncertainty brings both risk and opportunity.

Why Meta Is on Trial: The Heart of the Antitrust Case

At the center of the trial is a sweeping antitrust lawsuit brought by the Federal Trade Commission (FTC) and a coalition of U.S. states, accusing Meta of maintaining a social networking monopoly through anticompetitive acquisitions and exclusionary practices.

The core allegations include:

-

Anti-competitive Acquisitions: Meta’s past purchases of Instagram (2012) and WhatsApp (2014) are under fire. Regulators argue these deals were designed to neutralize emerging competitors before they could grow into serious threats.

-

Stifling Competition: Meta is accused of unfairly restricting access to its APIs and data for developers and third-party platforms that posed competitive risks — creating a “walled garden” that favored its own growth.

-

Market Domination: The FTC contends that Meta's practices allowed it to maintain dominance in personal social networking, limit user choice, and stifle innovation in the broader digital ecosystem.

While Meta has pushed back, saying these acquisitions were approved at the time and that competition is thriving thanks to TikTok and others, the trial aims to test whether its business model is compatible with U.S. antitrust law in the modern digital age.

Investor Sentiment: Between Uncertainty and Resilience

In the short term, the trial has already introduced market volatility. Meta’s stock dipped following the announcement of formal proceedings, as investors weighed the potential fallout of an unfavorable verdict. Concerns range from heavy fines and divestitures to platform restrictions that could curb Meta’s advertising revenue — a pillar of its $100B+ business.

Yet, seasoned investors also see resilience in Meta’s fundamentals:

-

A large user base across Facebook, Instagram, and WhatsApp

-

Strong quarterly earnings

-

A growing portfolio in AI and mixed reality

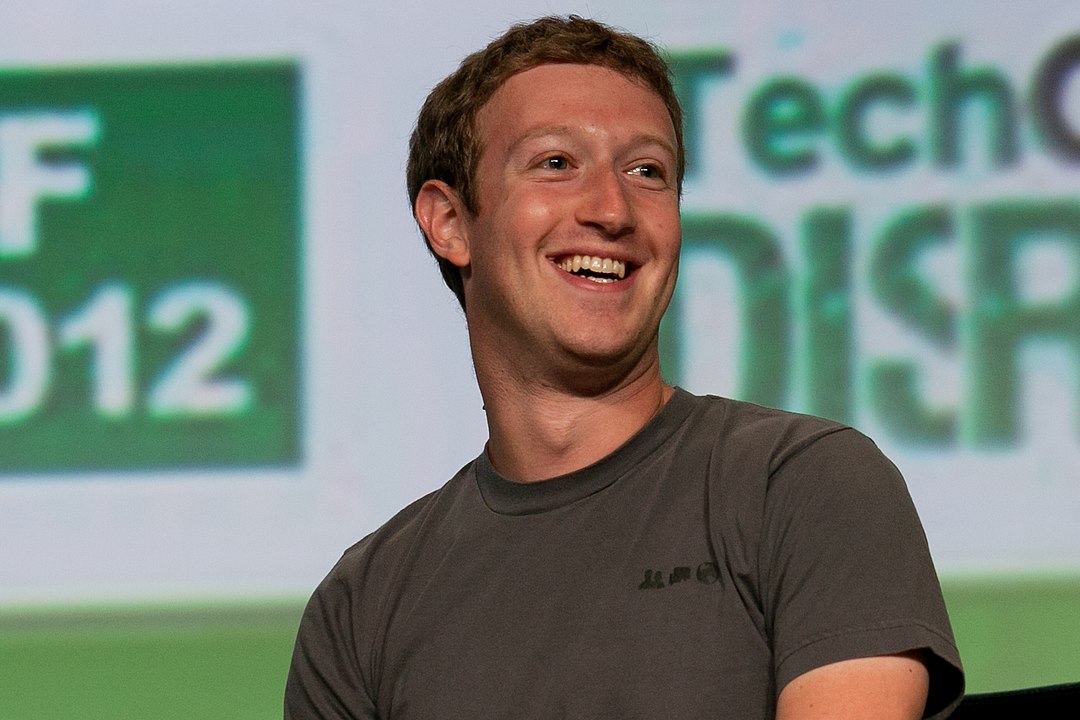

“Legal challenges are part of the cost of doing business at Meta’s scale,” said one portfolio manager. “It’s not the first time Zuckerberg’s team has had to defend their model — but the outcome here could be historic.”

Valuation Impact: Is Big Tech Still a Safe Haven?

For the last decade, tech stocks — especially the FAANG group (Facebook, Apple, Amazon, Netflix, Google) — have been considered relatively safe, high-growth investments. That perception is now being tested.

An extended trial or harsh ruling could:

-

Depress Meta’s P/E ratio compared to peers

-

Lead to increased regulatory premiums across the sector

-

Trigger valuation corrections for similarly structured tech firms

Meanwhile, investors are already rethinking exposure to companies with large-scale data practices or algorithm-driven content models. “If Meta is forced to restructure or spin off parts of its empire, that would have a domino effect on how we assess tech companies’ long-term scalability,” one equity analyst noted.

What This Means for the Tech Ecosystem

The implications go well beyond Meta. Here's what could change:

-

M&A Chills: Acquisitions like Meta’s purchase of Instagram and WhatsApp are now being reexamined. If courts move to unwind these deals or block future ones, other giants like Amazon or Microsoft may face stricter limits on expansion.

-

Data Privacy Models: A ruling that redefines data ownership or ad targeting protocols would send shockwaves through the digital advertising landscape, impacting Google, TikTok, and even newer AI startups.

-

Investor Shift to Compliance-Savvy Firms: Expect greater investor interest in companies that prioritize transparent data practices, ethical AI use, and lower regulatory risk.

Conclusion

As the legal battle unfolds, one thing is clear: the stakes are high for Meta, for investors, and for the future of Big Tech regulation. But despite the drama, Meta is likely to prevail in this round.

The company has deep legal resources, a history of surviving regulatory scrutiny, and the benefit of past acquisition approvals already on record. Courts are often hesitant to unwind deals retroactively, especially when years have passed and platforms like Instagram and WhatsApp have become deeply integrated into Meta’s ecosystem.