New data examined by Turnerlittle.com reveals the top 10 industries that suffer the highest business “death rates.” Achieved using the Business Demography release, published by ONS in November 2017.

“Death rate” definition: Businesses that have ceased to trade are referred to as business deaths. The death rate is calculated using the number of deaths as a proportion of the active enterprises.

It was found the number of UK business “deaths” increased from 283,000 to 328,000 between 2015-16; a death rate of 11.6%.

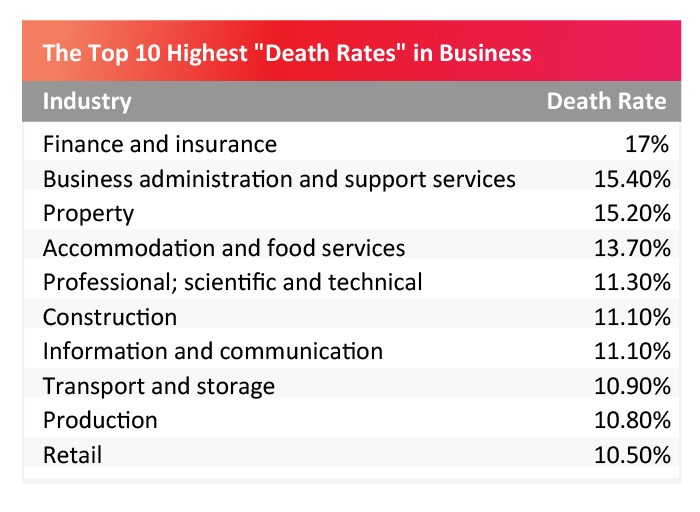

The highest rate, at 17% is seen in finance and insurance, compared with 13.3% in 2015. Followed by business administration and support, at 15.4% - compared with 10.1% in 2015.

From the infographic created by Turner Little, we can see that whilst finance and insurance (17%), business administration and support (15.4%) and property (15.2%) hold the top 3 highest death rates, exceedingly low death rates can be found in transport and storage (10.9%), production (20.8%) and retail (10.5%.)

The region with the highest business death rate was London, at 14%, followed by Scotland at 11.8%. Northern Ireland had the lowest death rate, at 9.2%.

Certainly, in the creation of new business, no matter the industry, there is huge risk. Turnerlittle.com highlights risk to be accredited to 5 key areas having assessed information provided by Entrepeneur.com:

Product Risk

If you can’t explain what you sell, why you’re selling it and why people should invest – you won’t secure interest and sales.

Market Risk

Knowing your customer and why, how and where they buy related products is arguably the most important risk factor to assess before launching a product.

Financial Risk

Make sure to identify key business milestones and schedules that clearly identify the points in time when equity or debt investments are necessary to reach the next major milestone. If you can articulate your business plan, growth path and reach each milestone successfully, this builds confidence in potential investors.

Team Risk

Invest in people who believe in your company and instil a sense of confidence that they can help get your company across the finish line – and maintain it.

Execution Risk

Many entrepreneurs can become so mired in the details that they completely lose sight of the overall company trajectory and strategy. Participate, evaluate the risks and don’t be afraid to pivot.

Further to this, Turnerlittle.com found the UK five-year survival rate for business born in 2011 and still active in 2016 was 44.1%. By region, the highest five-year survival rate was seen in the South West, at 47%, while the lowest was in London, at 41.7%.

By broad industry, some notably high five-year survival rates include health, with a survival rate of 54.1% and property, with a survival rate of 51.1%. Accommodation and food services had the lowest, with only 34.6% of businesses surviving for five years.

Managing director of Turnerlittle.com, James Turner notes: “It is obviously, incredibly important to evaluate all types of risk when thinking about starting – or investing in – a business. Financial loss can be devastating.

However, the potential for failure should never put you off trying. My advice would be to research, thoroughly, read case studies, speak to people who have both achieved success and faced loss, and always tread with awareness.”

(Source: Turnerlittle.com)