Nvidia's current market capitalization stands at $3.34 trillion USD. Our projection is that Nvidia will achieve a market capitalization of $8 trillion by 2030 or even earlier. This growth will be driven by a swift product roadmap, the strong competitive advantage provided by the CUDA software platform, and the company's position as a leading AI systems provider offering a wide range of components beyond GPUs, such as networking and software platforms.

Nvidia is now bigger than Microsoft. On Tuesday 18th June, 2024, Nvidia overtook Microsoft to become world's most valuable public company

Microsoft Market Cap: $3.32 trillion USD

Nvidia Market Cap: $3.34 trillion USD

Market Cap (Market capitalization, the total value of a publicly traded company's outstanding common shares owned by stockholders.)

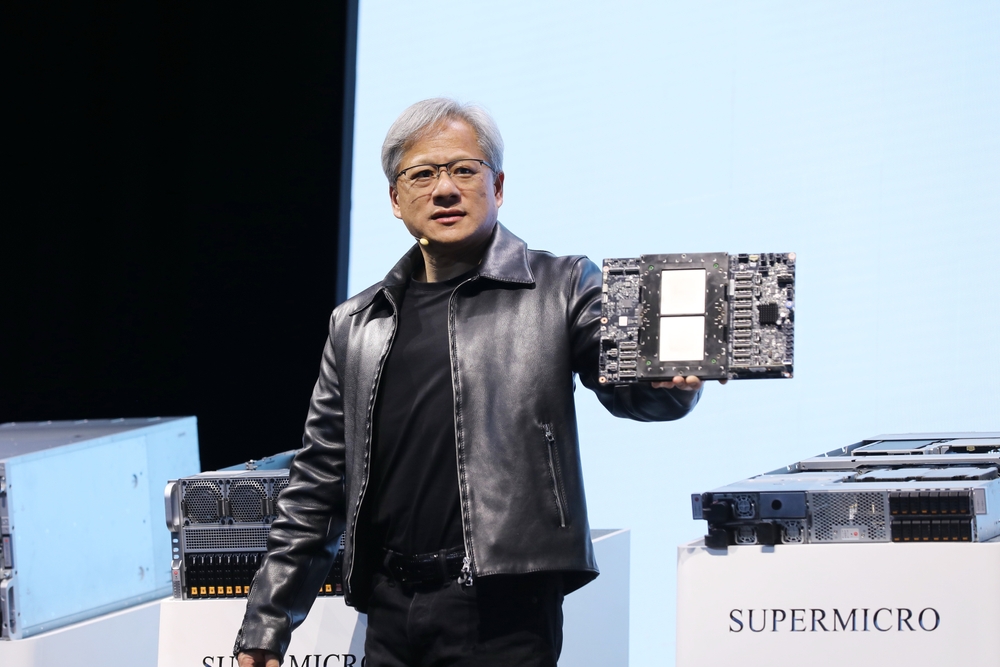

Headquartered in Santa Clara, California, Nvidia's billionaire CEO and Co Founder Jensen Huang's introduction of the GPU in 1999 not only addressed the issue of 3D graphics for the PC but also ignited the expansion of the PC gaming industry, reshaped contemporary computer graphics, and transformed parallel computing. The advent of GPU computing sparked the dawn of modern AI, ushering in a new era of computational power. Serving as the central processing unit for computers, robots, and autonomous vehicles, the GPU has become the cognitive powerhouse that enables perception and comprehension of the world. Presently, NVIDIA boasts a workforce of 12,000 individuals.

Will Nvidia Share Price Increase?

Important Disclosure: It is essential to note that the information presented does not take into account your specific situation and should not be considered as personalized advice. Certain products highlighted are affiliated with partners who provide us with compensation. If you require any personal advice, please seek such advice from an independently qualified financial advisor.

It is difficult to accurately predict how a company's stock price will behave. The performance of a stock is influenced by both the internal performance of the business and the broader macroeconomic events that impact the markets it operates in. NVIDIA has been experiencing significant success due to the rise of AI. The AI industry is entering a phase that is expected to witness significant expansion and advancement. As a result, Nvidia's latest financial results surpassed market predictions by a considerable margin.

Jen-Hsun Huang (Jensen Huang) NVIDIA's Founder, President and CEO.

Nvidia Growth and Share Price

NVIDIA's recent move to introduce the Blackwell platform marks a significant shift in the realm of computing. This ground breaking platform empowers organizations to construct and operate real-time generative AI on trillion-parameter large language models, all while reducing costs and energy consumption by up to 25 times compared to its predecessor. As a result, NVIDIA's stock has soared, leaving competitors in a frenzy. This audacious move sets a promising trajectory for the future of enterprise applications. As well the company demonstrated exceptional foresight in acknowledging the revolutionary capabilities of AI at an early stage and has consistently made substantial investments in this domain over numerous years. Consequently, it has emerged as the unrivaled frontrunner in manufacturing chips capable of executing intricate AI operations. Nvidia had a dominant 98% market share in data-center GPU shipments in 2023, similar to market share numbers in 2022 as well as a 98% revenue share of the data-center GPU revenue market with $36.2 billion, more than three times the growth from $10.9 billion in 2022.

Share Price: $135.58 (Thursday 20th June, 2024)

- Nvidia Share price has increase by 3,477% in the last 5 years

- Nvidia Share price has increase by 209% in the last 12 months

- Nvidia Share price has increase by 181% in the last 6 months

- Nvidia Share price has increase by 43.05% in the last 30 days

AI is here to stay and Nvidia are in pole position. If you think Nvidia looks expensive now, American share just might get pricier.

Published by: www.ceotodaymagazine.com - Thursday 20th June, 2024

The information on our website is not financial advice, and you should not consider it to be financial advice. You should always seek appropriate financial advice from a professional financial advisor. You should not consider this or any other website as a substitute for these services.