Did you know that poor cash flow management accounts for 82% of small business failures? There is more to cash flow than just a number. It is essential to your company. Nonetheless, a lot of business owners still rely on spreadsheets, which puts them at risk for mistakes, late payments, and financial blind spots.

Consider missing payroll due to an unforeseen expense that drained your account. The stress of pursuing payments, juggling accounts, and guessing your financial situation might keep you awake. Without real-time visibility, you risk making key judgments with out-of-date information.

And the best news? There is a more innovative solution.

Automated forecasts, real-time tracking, and scenario planning make modern cash flow projection tools essential for any business. This technology removes guesswork and helps ensure steady cash flow for growth and stability. Continue reading.

Key Features to Look for in Cash Flow Management Software

Businesses can only fully benefit from cash flow management software by choosing a solution packed with essential features that improve financial management and support informed decisions.

Here are the key features to consider when choosing your solution:

Real-Time Cash Flow Tracking

Businesses need instant access to their cash position. A robust cash flow management tool should provide real-time tracking, displaying current balances, inflows, and outflows. This feature ensures businesses stay proactive, catching potential shortfalls before they become critical.

Automated Forecasting

Manual calculations slow down financial planning. The best tools automate financial projections by pulling real-time data and predicting future cash flow trends. Cash Flow Frog simplifies forecasting by analyzing past transactions and estimating future cash flow scenarios.

(Image: Cash Flow Frog)

Expense and Income Categorization

Clear financial insights depend on proper organization. To make it simpler to monitor expenditure trends, spot wasteful spending, and improve budgets, a cash flow management solution should automatically classify income and expenses.

Scenario Analysis and Projections

Businesses must prepare for best- and worst-case financial scenarios. The software should allow scenario planning, enabling users to create multiple projections and assess the impact of different financial decisions. This helps companies navigate uncertainties and improve long-term strategy.

Integration with Accounting Tools

Accounting platforms like QuickBooks, Xero, FreshBooks, and Sage Intacct integrate effortlessly to streamline financial administration. By automatically syncing transactions, firms prevent repeated data entry and assure the accuracy of traditional cash flow forecasting methods.

Customizable Reporting

Every business has specific financial reporting requirements. The finest cash flow software offers customizable reports, allowing users to obtain deep insights, filter data, and see trends. Custom reports enable stakeholders to make educated financial decisions more quickly.

Invoice and Payment Management

Careful tracking of payments is necessary to maintain cash flow. To assist businesses in reducing late payments and improving cash flow predictability, the finest cash flow management software provides automatic payment reminders and invoice tracking.

Mobile Accessibility

Decision-making is improved when financial data is accessible while on the road. To enable business owners and financial managers to monitor balances, track expenses, and run predictions from any device, a cloud-based cash flow management application should be mobile-compatible.

Multi-User Collaboration

Several team members are frequently involved in financial management. In order to facilitate safe collaboration between accountants, managers, and business owners, the software should allow for multiple users with varying levels of permission.

Security Features

Protecting financial information is a critical issue. The greatest cash flow management technologies include data encryption, two-factor authentication, and secure backups, which protect sensitive corporate information from cyber attacks.

Using software with these qualities results in more financial visibility and more imaginative, confident decisions.

Benefits of Choosing the Right Software

Selecting the right cash flow projection tool offers numerous advantages:

- Better cash flow visibility – Avoid surprises, track trends, and make informed financial decisions.

- Time savings – Automate calculations, streamline processes and reduce manual data entry.

- Improved financial planning - Combine classic cash flow forecasting methods with contemporary technologies to increase accuracy and efficiency.

- Stronger financial control - Involves identifying risks early, planning for future growth, ensuring stability, and making data-driven decisions.

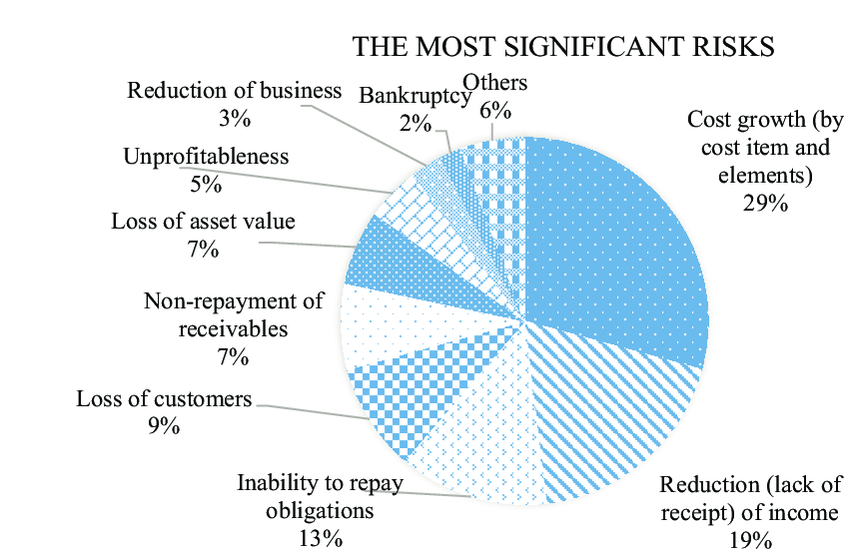

Important company hazards that are often brought on by a lack of cash flow visibility are depicted in the chart, including cost increases (29%), and income reductions (19%). Companies may anticipate these risks, reduce surprises, and make better financial decisions by using real-time tracking and forecasting.

Key risks linked to poor cash flow visibility. (Source: ResearchGate)

With the right tool, businesses can streamline cash flow management, reduce errors, and drive sustainable growth.

Final Thoughts

Ensuring financial stability starts with effective cash flow management. The right software—offering real-time tracking, automated forecasting, and easy accounting integration—transforms traditional cash flow forecasting into a streamlined process.

Cash Flow Frog blends automation with traditional cash flow forecasting to ensure your company’s financial health and growth readiness. Invest in the right tools today to manage your cash flow with confidence.

Have questions about cash flow management tools or need help selecting the best one? Please leave your comments or contact us today. We'd be thrilled to connect with you and assist you!