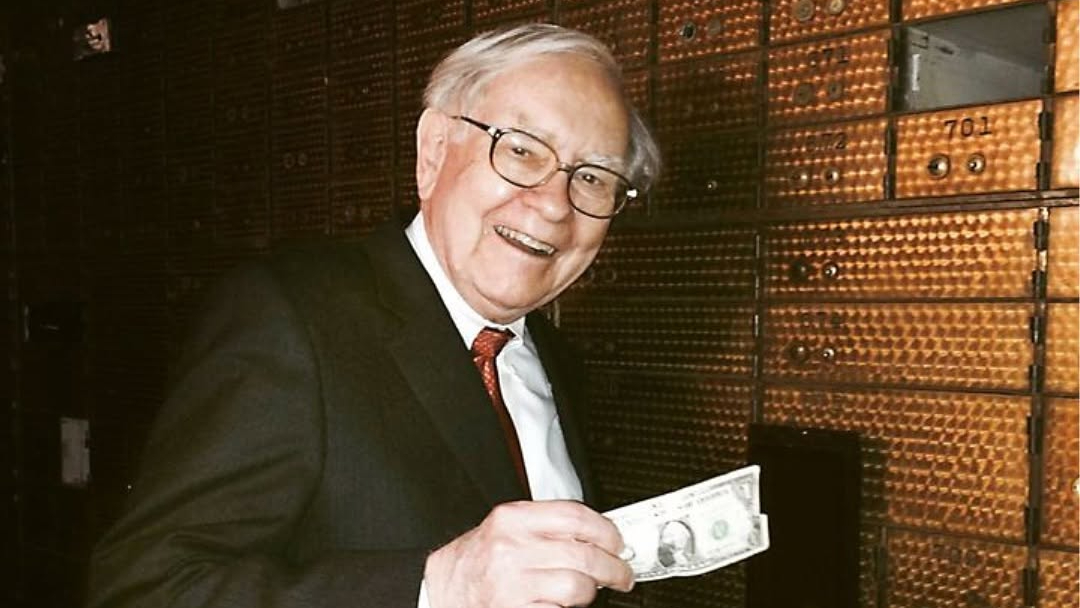

How Warren Buffett Made His First Million Dollars

Warren Buffett, one of the world’s greatest investors, didn’t become a billionaire overnight. His journey started with small, strategic investments, a disciplined approach, and a deep understanding of value investing. But how did he make his first million? Let’s break it down.

- Age: 94 (born August 30, 1930)

- Business: CEO of Berkshire Hathaway, investor, philanthropist

- Height: 5’10” (178 cm)

- Spouse: Astrid Menks (married in 2006), previously married to Susan Buffett (until her passing in 2004)

- Children: Susan, Howard, and Peter Buffett

- Net Worth: $146.2 billion (as of 2024)

How Did Warren Buffett Make His Money in the Beginning?

Buffett’s first major step into the world of serious investing started in 1956, when his mentor, Benjamin Graham, retired. At the age of 25, Buffett launched Buffett Partnership Ltd., a wealth management firm with a unique fee structure. Instead of charging management fees, he took 25% of any profits above a 6% return.

His Investment Strategy

Buffett followed the value investing principles he learned from Graham. His approach was simple:

Find undervalued companies with strong fundamentals.

Buy them at a discount (50% below intrinsic value).

Hold onto them long-term and let their value grow.

Buffett’s firm saw incredible success, averaging 31.6% annual returns from 1957 to 1968, and he never had a losing year.

Related: Warren Buffett’s Top Book Recommendations for Success

Related: Warren Buffett’s 80/20 Rule: The Key to Smarter Investing

Related: Warren Buffett: The Billionaire’s Daily Routine & Secrets to Success

A Focused Portfolio

Unlike many investors who diversify across hundreds of stocks, Buffett kept a small, focused portfolio of 10–30 high-quality businesses. He reinvested his profits into those same businesses, allowing his wealth to compound over time.

Read more about Warren Buffett's by the author and investor Robert Hagstrom about The Warren Buffett Way describing the twelve investment tenets of Warren Buffett's strategy called business-driven investing and his distinct approach to managing a portfolio of businesses. Find the book here.

How Long Did It Take for Warren Buffett to Make His First Million?

By 1962, at the age of 32, Buffett had grown his investments to over $1 million (which would be over $10 million in today’s dollars).

His first million was just the beginning. That same year, he started buying shares of Berkshire Hathaway, a struggling textile company. By 1964, he had gained majority control and turned it into one of the most valuable companies in the world.

Key Takeaways from Buffett’s First Million

Start Early: Buffett began investing as a teenager, proving that the earlier you start, the better.

Stick to What You Know: He only invested in businesses he fully understood.

Value Investing Works: Buying undervalued stocks at a discount was his key strategy.

Long-Term Mindset: Buffett’s philosophy was to buy and hold forever.

Compounding Is Powerful: Reinvesting profits allowed his wealth to snowball.

Buffett’s journey to his first million laid the foundation for the billions he would later accumulate. His strategy of patience, smart investing, and discipline proves that anyone can build wealth with the right approach.