Warren Buffett’s Billion-Dollar Gut: How He Seals Deals Without Seeing the Product

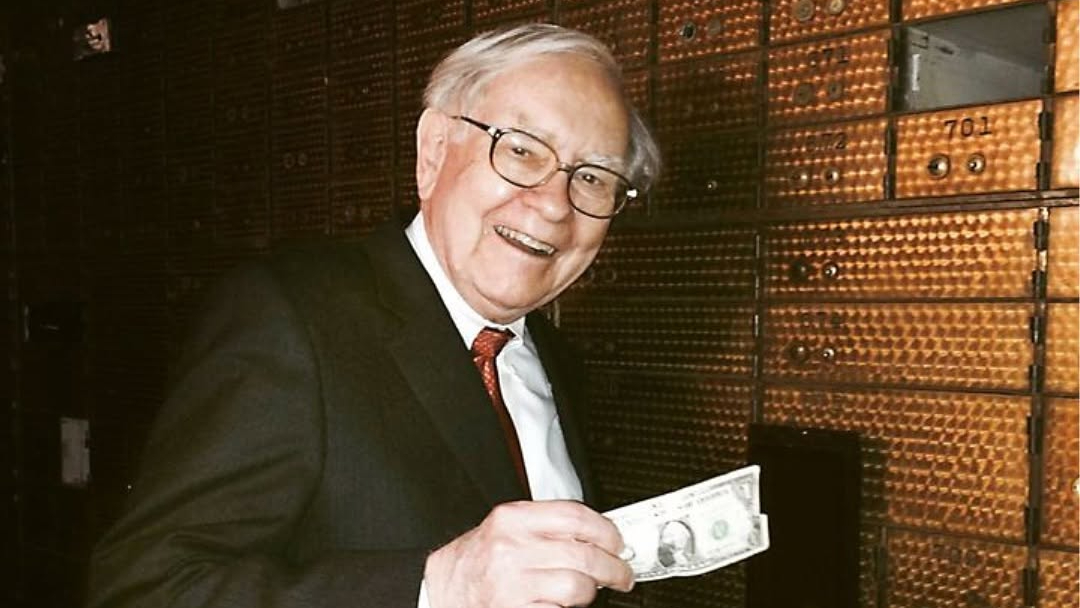

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, is known for his razor-sharp business instincts, a talent that has earned him the nickname "The Oracle of Omaha." But what truly sets Buffett apart isn’t just his ability to spot a great deal—it’s his unwavering confidence in making billion-dollar decisions without ever laying eyes on the product.

A prime example? His $4 billion acquisition of Iscar, an Israeli metalworking company, which he bought sight unseen.

The Iscar Deal: A $4 Billion Leap of Faith

In 2006, Buffett was approached with an opportunity to acquire Iscar, a cutting-edge manufacturer of metal-cutting tools. While most CEOs would demand extensive due diligence, factory tours, and endless meetings before committing billions, Buffett needed none of that.

"I love your business, I love you, I'll give you $4 billion," Buffett reportedly told the company’s owner, Eitan Wertheimer. But there was one catch: Buffett wasn’t interested in crossing oceans or visiting factories.

Wertheimer, eager to showcase the fruits of his labor, insisted that Buffett visit the factory. In classic Buffett fashion, he made a deal:

"If you sell me the business, I'll come visit. But not before."

The sale went through, and true to his word, Buffett eventually visited the Iscar factory. What he saw left him speechless.

"If I'd seen this thing, I'd have paid you more money," Buffett later admitted. And that’s precisely why he prefers not to visit businesses before making a deal.

Related: Warren Buffett’s Homes: Where the Billionaire Lives in 2025

Related: Meet Warren Buffett’s Children: The Heirs Shaping His Philanthropic Legacy

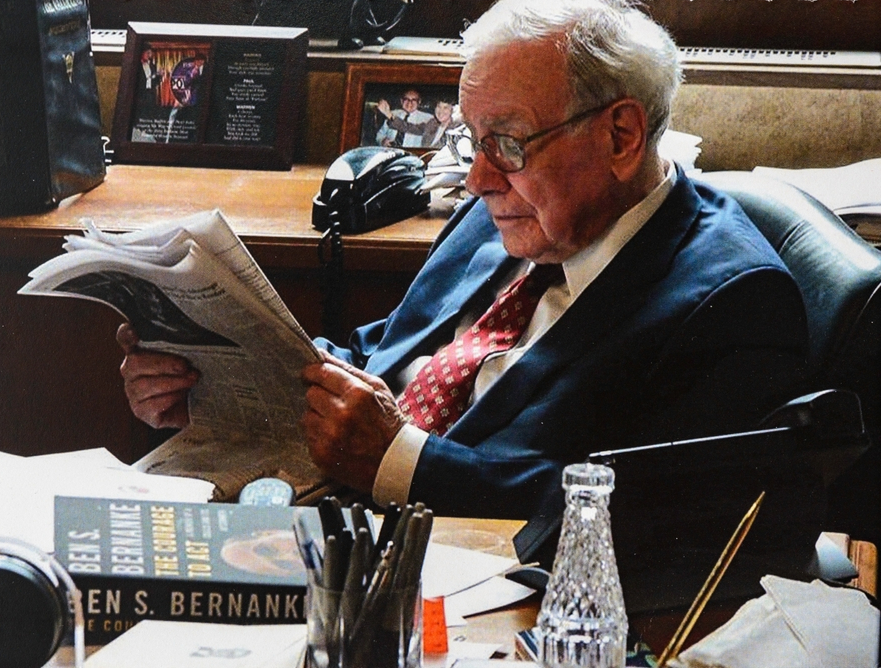

Why Buffett Trusts His Instincts Over Inspections

Buffett’s confidence in his investment decisions is rooted in decades of experience, a deep understanding of business fundamentals, and an uncanny ability to assess people. His approach prioritizes trust in leadership, strong business models, and long-term profitability over superficial inspections or site visits.

According to Buffett, “I don’t need to see the factory. I need to see the numbers, the management, and the potential.”

His strategy focuses on evaluating a company’s intrinsic value, leadership capabilities, and future earning potential—all without needing to witness production lines or operational details firsthand.

The Secret Sauce: Buffett’s Investment Philosophy

Buffett’s success stems from a few core principles that guide his decision-making process:

-

Invest in What You Understand: Buffett sticks to industries and companies he fully grasps, making it easier to assess their long-term value.

-

Bet on Strong Leadership: Buffett places immense trust in capable management, believing that great leaders can steer a business to success regardless of external challenges.

-

Focus on Long-Term Growth: Buffett isn’t interested in short-term gains. His approach focuses on companies with sustainable growth and long-term profitability.

Related: Warren Buffett’s Top Book Recommendations for Success

Related: Warren Buffett’s 80/20 Rule: The Key to Smarter Investing

A Track Record of Winning Without Seeing

Buffett’s ability to make high-stakes decisions without traditional due diligence isn’t limited to Iscar. His acquisition of Nebraska Furniture Mart, for instance, was sealed after a simple handshake with its founder, Rose Blumkin.

These seemingly unconventional methods have resulted in some of Berkshire Hathaway’s most profitable deals, reinforcing Buffett’s belief that trust, knowledge, and instinct outweigh factory tours and product demonstrations.

What We Can Learn from Buffett’s Confidence

Warren Buffett’s story serves as a masterclass in business confidence and decision-making. His success proves that while numbers and data matter, understanding the people behind a business and believing in its potential is often the real key to making billion-dollar deals.

In a world where most investors hesitate without exhaustive research, Buffett’s approach is a powerful reminder that sometimes, a gut feeling—backed by knowledge and experience—is all you really need.