Nvidia’s Downfall? Chip Export Crackdown Sends Stock Tumbling

Nvidia, the reigning king of AI chips, has seen its stock take a sudden dive and investors are scrambling to understand what’s behind the drop. With export restrictions tightening around advanced semiconductors, Nvidia’s exposure to international markets, particularly China, is under the microscope. Could this be the start of a rocky road for one of Wall Street’s hottest tech darlings?

Why is Nvidia Falling?

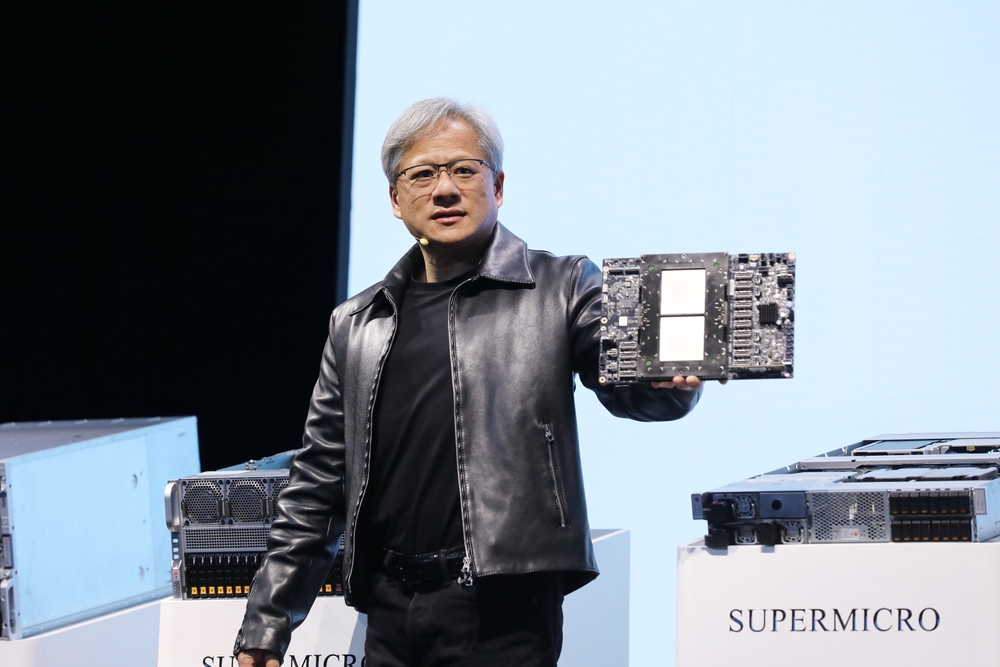

The primary trigger for Nvidia’s recent stock decline is the U.S. government’s crackdown on AI chip exports to China and other restricted regions. Nvidia's high-performance chips, such as the H100 and A100 critical for artificial intelligence applications are in high demand worldwide according to Yahoo Fiance. But with new restrictions, the company is facing a significant dent in international revenue streams.

Washington is aiming to curb China's AI advancements by limiting access to cutting-edge U.S. technology. Unfortunately, Nvidia, which earns a notable chunk of its revenue from Chinese buyers, is caught in the geopolitical crossfire. This has spooked investors and prompted a sell-off in anticipation of slower growth.

Is Nvidia a Buy or Sell Today?

Despite the short-term headwinds, opinions are split. Bulls argue that Nvidia’s fundamentals remain strong: it's still a leader in AI, has a dominant position in data center GPUs, and is poised to benefit massively from the AI boom. Dips like this could be viewed as a buying opportunity for long-term investors.

Bears, however, caution that the valuation is still sky-high, and any disruption to Nvidia's global sales especially in the face of increasing competition and export risk, could trigger deeper corrections as stated on TipRanks.

Bottom line? If you're in it for the long haul and can stomach volatility, analysts say Nvidia may still be worth holding. But if you're looking for stability, you might want to wait for clearer skies.

Related: China Strikes Back: How Tariffs on U.S. Goods Could Spark Global Chaos

Related: Trump’s Tariff Trap: Why He’s Still Bullying China

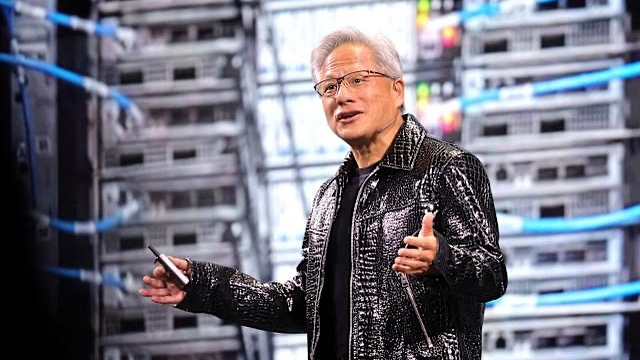

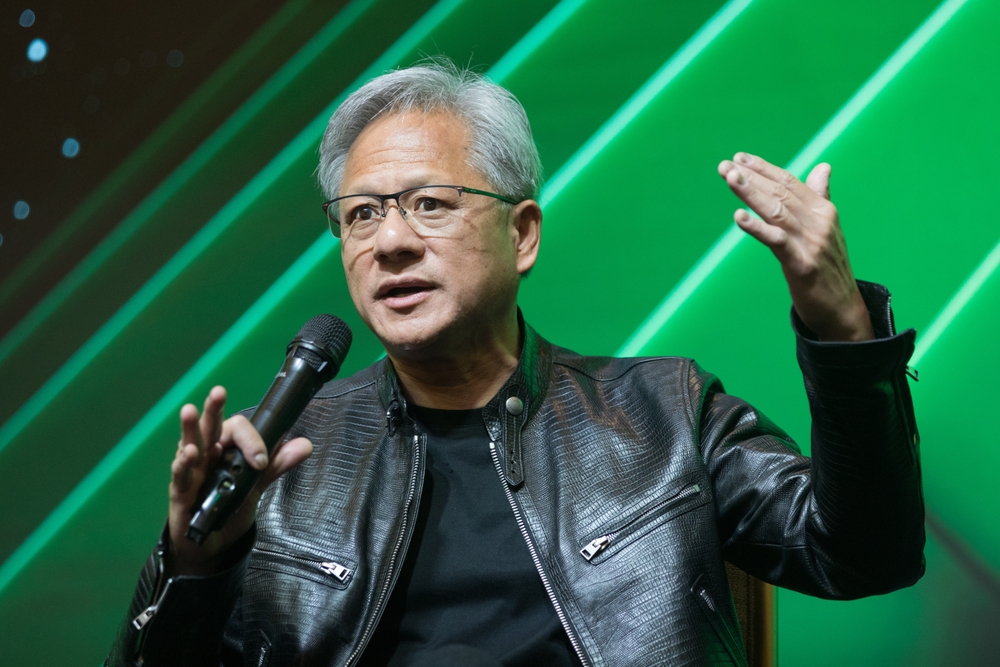

Jen-Hsun Huang (Jensen Huang) NVIDIA's Founder, President and CEO.

Could Nvidia Top $1,000 a Share in 2026?

It’s a bold prediction but not impossible. Some analysts from BarChart believe Nvidia could surpass $1,000 a share by 2026 if AI adoption accelerates, demand for high-performance chips remains robust, and export risks are either mitigated or redirected to other markets.

The key growth drivers? Continued dominance in data centers, expansion into automotive AI, and growing adoption of generative AI by big tech. If Nvidia can successfully diversify its customer base and stay ahead of rivals like AMD and Intel, the road to $1,000 isn’t just wishful thinking, it’s on the table.

Related: Trump’s Tariffs vs. Apple: Will Your Next iPhone Cost More?

Who Is the Largest Investor in Nvidia?

As of the most recent filings from Investor's Business Daily, Vanguard Group holds the title of Nvidia’s largest institutional shareholder, followed closely by BlackRock. These investment giants own billions of dollars worth of NVDA shares, reinforcing the stock’s reputation as a core holding in many growth-focused portfolios.

Insiders, including CEO Jensen Huang, also maintain substantial holdings signaling their long-term confidence in the company's trajectory.

Conclusion

Trump’s tariffs are once again lighting a fuse under the global tech economy and Nvidia’s stumble is just the beginning. If a trillion-dollar titan like Nvidia can get rattled by export restrictions, imagine the shockwaves heading for smaller chipmakers and startups who rely on international demand to survive. When successful giants are vulnerable, the little guys are staring down collapse.