Who Leads the Fed in 2025? Jerome Powell’s Role and the Power of the Federal Reserve

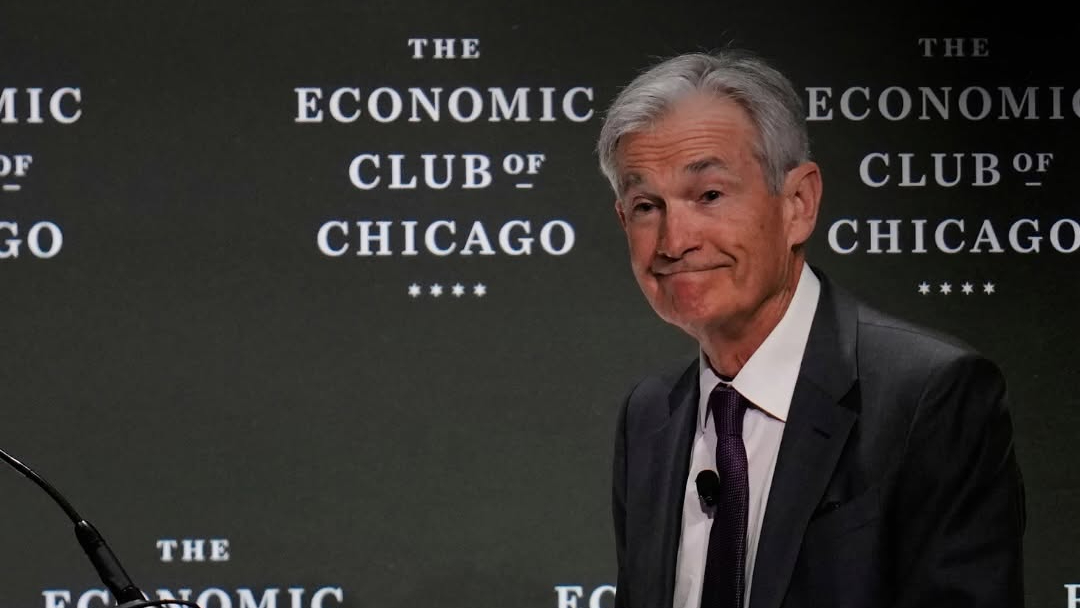

Federal Reserve Chair Jerome Powell has come under intensified scrutiny from President Donald Trump, who has publicly criticized Powell's reluctance to lower interest rates. Trump labeled Powell a "major loser" on social media and suggested his removal, actions that have unsettled financial markets and raised concerns about the Fed's independence.

Who Is the Chair of the Federal Reserve in 2025?

As of April 2025, Jerome Powell continues to serve as the Chair of the Federal Reserve, the central bank of the United States. Appointed initially in 2018, Powell was reappointed by President Joe Biden in 2022 for a second four-year term, set to conclude in May 2026.

Powell, a seasoned lawyer and former investment banker, has been a member of the Fed's Board of Governors since 2012. His tenure as Chair has been marked by navigating the U.S. economy through challenges such as the COVID-19 pandemic, inflationary pressures, and evolving monetary policies.

Related: Jerome Powell: From Law to the Fed’s Helm

Who Owns the Federal Reserve?

The Federal Reserve System is a unique entity in the U.S. financial landscape. It comprises:

-

Board of Governors: A federal agency based in Washington, D.C., whose members are appointed by the President and confirmed by the Senate.

-

12 Regional Federal Reserve Banks: These operate independently but under the supervision of the Board of Governors. They are structured similarly to private corporations, with member banks holding stock in their respective regional Fed banks.

Importantly, the Federal Reserve is not "owned" by anyone. While member banks hold stock in regional Fed banks, this stock does not carry the control typical of corporate stock. The Fed operates independently within the government framework, aiming to serve the public interest.

@Fortunemag

What Is Jerome Powell’s Salary?

As Chair of the Federal Reserve, Jerome Powell earns an annual salary of approximately $190,000. This compensation is modest compared to private sector executives, reflecting the public service nature of the role.

Related: Courtroom Gender Wars: Governments Rewrite Reality While Bigger Crises Burn

Related: Jensen Huang: The Visionary Who Transformed Nvidia into a $3 Trillion AI Titan

Can the President Replace the Fed Chair?

The President of the United States cannot unilaterally remove the Federal Reserve Chair. According to the Federal Reserve Act, a member of the Board of Governors, including the Chair, can only be removed "for cause," which typically means misconduct or incapacity, not policy disagreements.

Recent tensions have arisen, with former President Donald Trump expressing dissatisfaction with Powell's policies and exploring options to remove him. However, legal experts agree that such an action would face significant legal challenges and could undermine the Fed's independence.

@abcnews

How Powerful Is the Chair of the Federal Reserve?

The Chair of the Federal Reserve is considered one of the most influential figures in global finance. Responsibilities include:

-

Setting Monetary Policy: Leading the Federal Open Market Committee (FOMC) in determining interest rates and other monetary policies.

-

Economic Oversight: Monitoring and responding to economic indicators to promote maximum employment and stable prices.

-

Financial Regulation: Overseeing the regulation of banks and financial institutions to ensure system stability.

While the Chair holds significant sway, decisions are made collaboratively within the FOMC and the Board of Governors, ensuring a balance of perspectives.

Conclusion

The Federal Reserve was designed to operate independently and for good reason. When short-term political interests interfere with long-term economic policy, the results can be disastrous. As recent tensions between Jerome Powell and President Trump have shown, even the perception of political influence can rattle markets and undermine confidence.

The Fed’s mission is to stabilize the economy, not to serve political agendas. If the White House could hire and fire the Chair based on policy disagreements, it would compromise the very autonomy that keeps inflation in check and markets steady.